![A Louis Vuitton Bag Beats S&P 500 During Inflation, Here's Why [Research + Infographic]](http://lvbagaholic.com/cdn/shop/articles/louis_vuitton_bag_as_investment_infographic_research_1445x.png?v=1695388843)

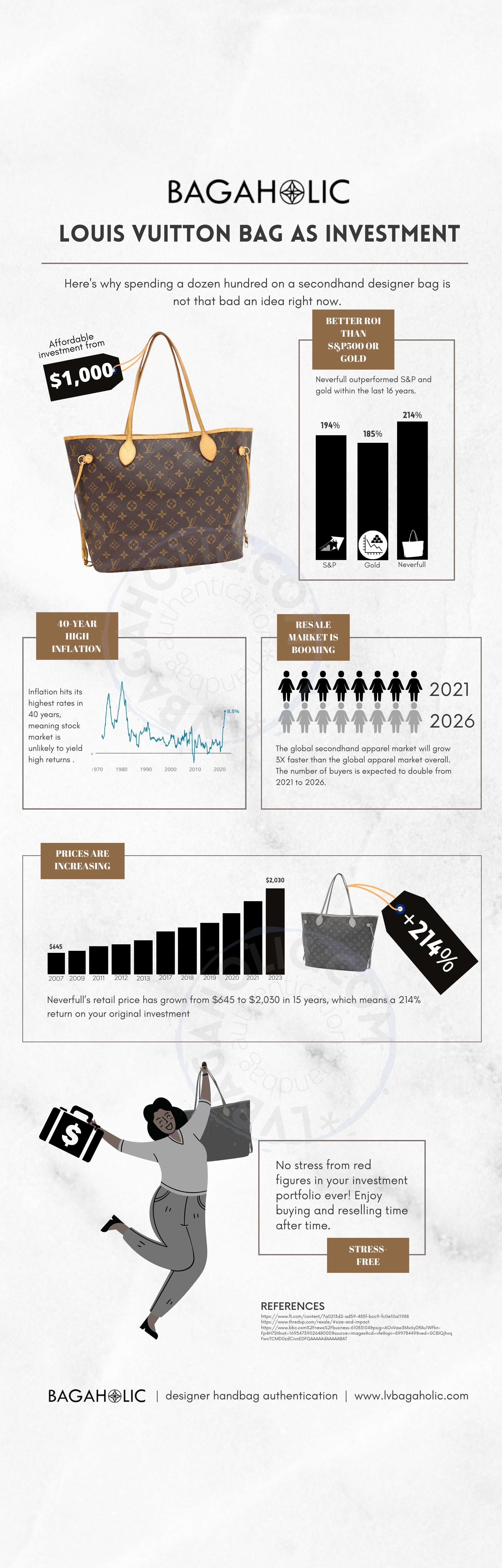

Do you believe that spending several thousand dollars on a luxury handbag may actually be a better investment than going for S&P 500 index or gold during inflation? Find out the best Louis Vuitton bag to invest in!

In this article, Bagaholic presents historical data on Louis Vuitton Neverfull, one of the most popular designer handbags in the world. We'll compare investing in this handbag to investing in S&P 500 index and gold on several timeframes to see if a Louis Vuitton bag can beat the most popular conservative investment tools.

In addition, we'll research why an item that may seem an unnecessary expense, can actually become an investment with best returns.

A 16-year span is taken as the purse was released 16 years back.

1. Louis Vuitton prices are only rising

According to research data from TheRealReal, Louis Vuitton and Chanel are among the brands that hold their value best over time. Both brands have turned handbags into an ultimate girl's dream and a valuable item.

That being said, not all handbags from these two brands are equal in terms of their return on investment.

Introduced in 2007, Neverfull’s retail price has grown from $645 to $2,030 in 15 years, which means a 305% return on your original investment. Not bad considering an average S&P 500 return of 12%, which would result in increasing your capital by 180% only . Within 5 years alone, we witnessed an impressive price spike from $1,180 to $2,030, 80% up total.

And we’re only talking retail here. If you manage to get a good deal on a preloved handbag, the return on investment can be twice as impressive.

2. Neverfull Still Beats S&P 500 Index in 2023

Investing in an asset, let's say an Apple stock, is neither good nor bad in itself. What this investment will bring is laying on two pillars: when you buy and when you sell.

While S&P 500's historic annualized average return is 10.5%, let's see if a bag can beat that on a 15-year scale.

Between 2007 and 2023, S&P 500 index rose from 1474 points to about 4330 points, which means a 194% return on the original investment. Meanwhile, Neverfull's price has demonstrated solid growth by 214%, from $645 to $2,030.

Not only does Neverfull outperforms S&P 500. If you've been purchasing stocks, there's a fair chance that your portfolio might sink as inflation is rising. With physical assets such as handbags, on the contrary, it’s unlikely that prices will be going down any time soon. Moreover, each year the French purse manufacturer raises the prices even further. Considering we are facing the recession with the highest inflation rates in our conscious life, next year the coveted purse will even become less achievable.

3. Neverfull Is a Better Investment than Gold

Having taken the 10-span, gold has been struggling with growth. According to Macrotrends data, in a 10-year timeframe from 2013 to 2023 gold value has increased by 60% from $1,206 in 2012 to $1,925 in 2023. Had you invested a $850 in gold back then, it would only turn to $1,360 plus you'd have to live 10 years through the stress of seeing your investment going as low as -35% at times.

On a 16-year span, however, a price per ounce of gold has risen from $677 to $1,925, representing a 185% return on the original investment. The Neverfull’s retail price has grown from $645 to $2,030 in 15 years, which means a 214% return on your original investment, outperforming gold assets.

While gold is considered an asset for a conservative investment portfolio, it's still susceptible to significant fluctuations.

4. Inflation is accelerating

With inflation hitting a 40-year high in July 2022, even Elon Musk admits that 'physical assets are generally the safest investment during times of high inflation'.

While salaries are struggling to keep up with inflation, it looks like households will tend to spend less in the upcoming years. And it doesn't promise a positive outlook for the stock market. As long as consumers spend less, big enterprise profits will lack record high levels, which, in its turn, means the major stocks are likely to either stay on the same price level or just sink.

S&P’s outlook isn’t optimistic with tons of cheap money poured into market during the pandemic and will presumably take at least a few years to pull back.

5. Only $1,000 Needed to Start Investing in Designer Handbags

First of all, investing in a handbag is much more affordable than any other physical goods assets, such as cars, wine or watches.

Second, even if $2,030 seems to be quite high, good news is that you can start with even less.

How could that be?

Investing in particular asset doesn’t necessarily compare to any potential returns. When and where you purchased this stock speaks volumes.

With handbags, it’s the same. With secondhand shopping booming, you don't need to pay the store price.

If you monitor deals closely, you are on the driver’s seat to your finances, which means you manage how much you invest and how much you get in return. Having invested some time in exchange for experience, you’ll easily outperform the historical annual Neverfull's price growth.

According to our preloved Neverfull Price research, it's possible to find a Louis Vuitton Neverfull MM in good condition in resale for around $800, you are likely to sell it higher in 2 years. One of our customers has recently revealed that she bought a Neverfull for $500 just a few years back. Now she sold the purse $700 in within less than an hour. That is a 40% return on the original investment. Not bad at all.

As the secondhand luxury market is flooded with counterfeits, the most important step while purchasing a preloved designer purse is making sure it's authentic. You can order professional preloved designer handbag authentication from Bagaholic.

6. No Stress From Red Figures, Ever

When it comes to investing goals, capital growth is often seen as a number one goal, while in reality it's preserving the capital and preventing loss that is a rule of thumb that precedes capital gains.

Secondhand handbags perform incredibly good. As the retail baseline is growing, so do preloved items. In fact, it seems that they don't lose value at all.

On top of that, having an investment portfolio comprised of handbags is much less stressful than watching your stocks sinking into red even more every day. You use the power of retail therapy and at the same time make a safe investment, now how good is that?

7. It's Not That Crowded Here... Yet

Many renowned investment advisors list physical assets such as real estate, wine and fine arts as the safest types of investment. Few take luxury handbags seriously and even if they do, they're generally speaking about Hermes Birkin / Kelly handbags.

It's likely that in the upcoming years we'll face something comparable to gold rush, only with more affordable physical assets, such as designer handbags.

Summary

Neverfull is The Best Louis Vuitton Bag to Invest In

Luxury brands like Louis Vuitton or Chanel carefully preserve their value. There are no sales and no discounts, and secondhand pieces tend to keep their high value.

This research presented historic data on how Louis Vuitton Neverfull purse compares against S&P500 and gold, with the benefit of hindsight. Based on these data, one can predict that luxury purses will only be increasing in value. There’s a reason why they call them ‘investment pieces’. And Neverfull is the best Louis Vuitton bag to invest in.

Investing in handbags seems to be a bizarre idea unless you do some fact-checking. With today’s major inflation jumping by most since 1981, while stocks and bonds make your investment portfolio turn to red, a designer handbag sounds like a perfect investment. It takes away your stress from seeing your stocks sinking, bringing the joy of compiling your unique handbag collection at the same time.

There are dozens of limited edition handbags that not only hold their value but sustain considerable price increases. If you're interested, check out Bagaholic's course 'How to Invest in Luxury Handbags'.

Comments

I have a question…do you honestly believe that someone is going to pay over 2K for a used bag that is over 15 years old? What I see from this data is an increase in retail price, (which is normal due to inflation) for an overpriced bag made in China!

Also, I do not see how a “handbag” is a “good investment”. I have an investment advisor and she DID NOT suggest that I purchase LV bag a s a part of my investment portfolio. I see this as a marketing ploy to get people these handbags!

Investing in Real estate is always a good investment as it does have the ability to rebound in a market downturn, can be used as collateral and can be transferred to your heirs. Please tell me…can a handbag do this? However, to each her own, but I prefer houses and lands because I can’t “live” in a handbag!